How Much Longer Do Women Have to Save to Buy a Home?

Mortgages can be notoriously difficult to navigate and even more challenging to afford – even before considering the gender pay gap, which takes many women longer to save for a mortgage deposit than their male counterparts.

We were interested in understanding how gender pay disparity affects women’s opportunities to enter the property market. So we sought to find out how long men and women in different industries have to save for the average property in the UK, with an 18% deposit.

After collating and analysing official data sets, we were able to compare these figures to see how far the pay gap sets women back when it comes to buying a home!

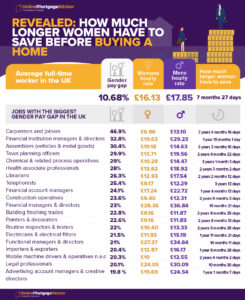

The Gender Pay Gap Between Average Full-Time Workers

Intrigued to understand how the pay gap might affect the ability of women to enter the property market, we first looked to calculate the gender pay gap between men and women on average among full-time workers in the UK. The research uncovered a 10.68% pay gap between the genders – a figure which revealed that women are paid roughly £1.72 less per hour than men, on average.

Whilst the figure might appear novel, we calculated how much longer this disparity would leave women saving for a property compared to men. If both genders were to save 20% of their annual salary each year to reach an 18% deposit for the average home, women would be forced to save for almost 8 months longer than men.

We estimate that saving for an 18% deposit on an average property priced at £235,673 would take men on the average salary 6 years, 1 month and 22 days. Meanwhile, saving for the same property on the average female salary would take an estimated 6 years, 9 months and 18 days.

The Top 5 Jobs with The Biggest Gender Pay Gaps

What’s more, our research found that in some industries and roles, women take up to 7 years longer to save for the same property as men in the same role! Other industries show similar trends:

1. Carpenters and Joiners

The biggest gender pay gap in the UK goes to Carpenters and Joiners, with females being paid almost 47% less compared to their male counterparts. In fact, the average hourly rate for a female Carpenter or Joiner was revealed to be £6.96, leaving women saving for a staggering 15 years, 9 months and 2 days to afford the average property deposit. On the other hand, male Carpenters and Joiners received £13.10 on average per hour, leaving them saving for 8 years, 4 months and 14 days – almost half of the average time for females!

2. Financial Institution Managers and Directors

The second highest gender pay gap goes to Financial Institution Managers and Directors. On average, women in these roles earned 32.8% less than men in the same role, despite earning an impressive average hourly rate of £19.63 – men in these roles earned around £10 more! Despite boasting the second largest pay gap, these roles left women saving for a further 1 year and 10 months longer than men according to our calculations – perhaps because their sizable salaries mean neither are left saving for too long for a deposit.

3. Assemblers of Vehicles and Metal Goods

Assemblers of Vehicles and Metal Goods followed shortly behind, with the third highest gender pay disparity – 30.4%. The wage difference leaves women in this role saving for 3 years and 3 months longer than men for a mortgage. In this role, females are paid an average of £10.18 per hour, meanwhile, men receive £14.63 per hour on average, leaving women saving for roughly a decade!

4. Town Planning Officers

Town Planning Officers also had an alarming gender pay gap, with women receiving 29.9% less on average compared to men. Female officers earn £13.71 on average per hour, whilst men are paid £19.56 – this large gap means that women in this role are required to save for roughly 2 years, 4 months and 22 days longer than men in the same role.

5. Chemical and Related Process Operatives

Rounding off the top 5 roles with the biggest gender pay gaps in the UK are Chemical and Related Process Operatives. We can reveal that females in this role received 29% less on average than men in the same role, leaving women saving for an additional 3 years and a month on average compared to male colleagues.

You Might Also Like: 10 Questions To Ask Your Mortgage Broker

The 3 Most Commonly Held Jobs Among Women in the UK

We also sought to discover the gender pay gap among industries where jobs are most commonly held by women, only to find that even within these roles females are paid less than men on average!

21% of all jobs held by women are in the health and social care sector, such as nursing, with 79% of roles occupied by females. By analysing the pay gap between the genders in roles such as Health and Social Services Managers and Directors, we can reveal that there is a 14.8% gender pay gap between the sexes, with women paid roughly £4 less per hour. This statistic means that females are estimated to have to save 8 months and 11 days longer than men in these roles, despite earning £23.46 an hour!

Similar could be seen in Sales and Retail Assistants, a role which 14% of women hold. Women in these roles earn £9 on average per hour, meanwhile, men in the same roles earn £11.59 – equating to a 4.40% wage gap! Such a gender pay gap leaves women saving for over half a year longer than male colleagues!

Women also dominate the UK education sector, with 70% of Teaching and Educational Professionals being female. Unfortunately for women, this dominance doesn’t equate to equal pay, since women in the field get 8% less than men on average! This means that with women receiving an average of £22 per hour in these roles and men earning £23.92, women would need to save for an additional 4 months and 24 days to reach the 18% deposit required for the average UK home.

The Highest Paying Jobs in the UK

When looking at the UK’s highest-paying roles, women still suffered a gender pay gap which left them waiting longer to be able to afford a mortgage deposit.

Legal Professionals proved to be the best-paid job in the UK among women, with an average hourly salary of £38.38 for women and £42.18 for men. Whilst both are paid well, females still receive 9% less than men for the same jobs, leaving them saving for 3 months and 18 days longer than men to get a mortgage and taking women 2 years, 10 months and 9 days to raise the 18% required.

Meanwhile, Chief Executives and Senior Officials pay women almost £38 per hour, whereas men £44.22 – £6.22 less. This 14.1% difference leaves women in the same roles saving for 4 months and 27 days longer on average to save a deposit for a property.

However, the third best paying job was that of Information Technology and Communications Directors, which had a far lower but still existent gender pay gap of 2.1%. In this role, women were found to earn £35.57 per hour, on average, whilst men earned £36.32. Owing to the lower gender pay disparity, women were predicted to only have to wait a further 24 days to reach the deposit total than men, making this one of the better and fairer paid jobs for women looking to enter the property market!

Overall, our research reveals a staggering difference in the salaries of men and women in identical roles, and gender pay gaps are holding women back from entering the property market and owning a home. The average full-time working female is estimated to save for almost 8 months longer than men in the same position, meanwhile, women in certain roles are left saving for 8 years longer than men in the same job!

Methodology

- Online Mortgage Advisor (OMA) used ONS earnings data to discover which jobs in the UK have the highest gender pay gap (rounded to the nearest 0.1%) and analysed the top 20.

- Next, OMA retrieved data from the Office of National Statistics which provided the hourly rate of each job for males and females. Based on this, Online Mortgage Advisor then found that from January – March 2020, the average weekly working hours were 36.5 hours, with 53 weeks in 2020. OMA calculated the yearly earnings per job by multiplying these figures.

- It is suggested as good practice that you should save 20% of your monthly salary, so OMA used this as a baseline for savings. However, it is worth noting that it doesn’t take into consideration other issues that may arise and could require you to dip into savings, such as a broken car.

- According to Money Supermarket, the average first time buyer will take out an 82% loan from their mortgage provider, leaving them to pay an 18% mortgage deposit on their home.

- OMA then found that the average price of a home in the UK is £235,673, according to Land Registry Data, and therefore an 18% deposit would cost £42,421.14. OMA refers to this figure throughout as what the first-time buyer would be working towards to ‘afford a mortgage’. The number of months needed to save for a mortgage is then calculated with these figures in mind.

- Finder.com noted that the average first time buyer is aged 34, so to find the average difference between full-time working males and females overall, OMA used ONS data to find that in 2019 (the latest figures) the weekly earnings for the average full-time working woman aged 30-39 was £588.70 and for the average full-time male aged 30-39 it was £651.60, a 10.68% difference in pay.