Your Mortgage Approval Is Finally Within Reach

Whatever your situation, we've got it covered. Bad credit? Complex income? Or looking to remortgage? Get matched to a mortgage broker right for you and get the "yes" you’ve been waiting for.

Find me a mortgage broker

Why use us?

Whatever your situation, at OnlineMortgageAdvisor we know that everyone's circumstances are different. That's why we only work with expert brokers who have a proven track record in securing mortgage approvals

-

Higher chance of approval

-

No impact on credit score

-

Mortgage Approval Guarantee - or £100 back*

-

We don't charge a fee

-

There for you every step of the way

-

Rated excellent on Trustpilot, Feefo and Google

If you have any questions,

feel free to call us on 0808 189 2301

How our service works

Our mission is to pair you with the perfect mortgage broker that suits your unique circumstances. To start the process, all you need to do is complete a straightforward form.

Fill in our quick form

Let us know the basics on our quick enquiry form, then we’ll match you to your perfect broker in minutes. And it won’t impact your credit score.

Get matched

We will match you to a real human being who’s an expert in your situation with a proven track record at finding the right mortgage solutions.

The right advice, first time

Your expert will find you the best deal that’s right for you and be with you every step of the way.

What we can help you with

Compare our mortgage broker-matching service

Take a look below to see why our free, mortgage broker-matching service is the best option for all of your mortgage requirements

OMA Service

Brokerage

Direct to Lender

Free to use

Wide range of lenders

Mortgage approval guarantee

Speed of service

Matched with a specialist advisor for your area of need

By your side from start to finish

We're so confident in our service, we guarantee it.

We know it's important for you to have complete confidence in our service, and trust that you're getting the best chance of mortgage approval at the best available rate. We guarantee to get your mortgage approved where others can't - or we'll give you £100*

Superb response and knowledgeable advisor

Steve, the financial advisor, contacted me within the hour and was very friendly, knowledgeable and professional. He seemed to relish my non standard requirement, diligently kept me updated during the day and we struck up a great relationship. Very impressed.

Peter Costello

Great Service

Everything has been smooth, contact has been nice and fast all of my questions have been answered fully

Martin

Very quick response

Very quick response from Pete. Very helpful, friendly and knowledgeable. I would definitely recommend. Thanks again Pete

Lindsey

Rated 4.8 out of 5 stars across Trustpilot, Feefo and Google

FAQs

Our mortgage broker-matching service is 100% free for you to use. We will pair you up with the perfect advisor for your needs and circumstances and set up a free consultation between you and them. There will be no obligation to take things further and your credit report won’t be affected.

A mortgage broker is a person or company that acts as an intermediary between customers and mortgage lenders. Their role is to help customers find the best mortgage deal available to them, offer expert advice and guide borrowers through the application process.

We always challenge the specialist mortgage brokers we work with to go that extra mile, so when we get a positive review, it means everything to us. Our customers consistently give us full marks on Feefo, so you can rest assured that you will receive a five-star service from the accredited broker we match you with, whatever your background.

A mortgage broker can help you (the customer) navigate every stage of the mortgage process, from finding the right deal to finalising the application. Services they provide include advice on which product to choose, searching the market for the most suitable mortgage lender to approach, and assistance with application forms and paperwork.

Some mortgage brokers are paid in commission by the lender while others might charge a fixed fee. There are also brokers who charge an hourly rate as well as those who earn a percentage of the loan amount, with a fee of up to 1% being industry standard.

Some of the advisors we work with charge no up-front fees and only get paid in lender commission when the deal reaches completion.

All brokers have access to the entire market, but some specialise in specific areas, such as buy-to-let investments, self-employed customers and bad credit mortgages. These areas often call for advisors with niche knowledge and expertise, and our broker-matching service will take that into account when pairing you with your ideal advisor.

Talk to us!

If you’re not quite ready to find a mortgage yet, let us know when you’re expecting to make your move. Fill in the form with the estimated date and your email address, and we’ll get back in touch on that date to give you the latest mortgage news.

Get in touch today

Make an enquiry and we'll arrange for an experienced mortgage broker we work with to contact you straight away.

The place for award winning advice

Tamsin's Story

"Without Online Mortgage Advisor we'd have certainly lost our home"

After a bad credit rating stopped Tamsin’s mortgage application in it’s tracks, see how expert advice helped Tamsin keep her family home, and read other success stories from our customers

Latest News

How Much Should You Expect to Pay in Mortgage Fees?

The interest rate youll pay on your mortgage is unfortunately far from the only...

Where are the Best Areas In the UK For Buy-to-Let Investors In 2024?

A recent market report issued in March 2023 by Zoopla has suggested buytolet ren...

Broker-Only Mortgage Lenders

Not all mortgage lenders are accessible on the high street or through a quick Go...

What is the Support for Mortgage Interest (SMI) Scheme?

The Support for Mortgage Interest SMI Scheme is a government loan designed to he...

5 Ways to Increase the Value of Your Home

For the first time in recent memory the housing market is starting to cool. Sell...

Are Mortgage Interest Rates Going Down?

Trying to figure out whether UK mortgage rates will go up or down can sometimes...

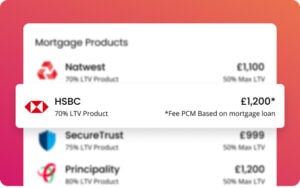

Access more of the market

Our free broker matching service ensures you’ll be connected with one of our vetted mortgage specialists, who can give you comprehensive advice based on your own personal circumstances. This means you can feel confident of being offered the best mortgage solution available to you.