OMA Academy Accreditation

Find out what makes an OMA accredited broker so invaluable.

At OnlineMortgageAdvisor our vision is simple – the right advice, for everyone.

Whether this is a straightforward best rate with a table topping deal, or a specialist mortgage for someone with complex circumstances. Whatever the reason, the mortgage should not get in the way of whatever our customers want to achieve.

When we work with so many firms and advisors, ensuring that everyone is able to give the right advice is essential in maintaining our position as the UK’s go-to for mortgages in all shapes and sizes.

The vision remains at the forefront of everything we do, with everyone involved displaying the OMA values and behaviours to deliver the mission consistently – this includes OMA accredited advisors, who provide a first-class service on the front line. Only advisors who fully understand, and agree with this should apply.

How we ensure the specialists are up to scratch

Personal Values

Firstly, we ensure that everyone working with us understands what we’re about, and hold the same values and behaviours dear. Be it marketing agencies, web designers, our lovely support team, and the large and growing network of firms and advisors, they must all carry OMA’s DNA.

OnlineMortgageAdvisor's Personal Values

Company & Advisor Assessments

Secondly, we only choose to work with the best. We have a strict policy on the types of firms we work with, and ensure that all individual advisors are well trained and experienced in their specified fields.

Not every broker is an expert in everything. There are over 3000 points of lending criteria and scores of lenders who change their policy regularly, so keeping on top of it all is almost impossible.

That’s why we specialise.

By assessing enquiries in a detailed way, we run complex algorithms to understand and categorise customers and then determine the absolute best advisor for the job, someone who successfully arranges mortgages in a precise sector of this massive market, on a daily basis.

To work out who these advisors are and that they are made of the right DNA, we do several things:

OMA Company Assessment

We run an extremely strict recruitment policy, only working with firms that are endorsed by industry experts, on an invite-only basis. We don’t just work with anyone, OMA’s Accredited firms are en exclusive club of experts.

- Have all necessary trading permissions

- Have confirmation of OMA sign off by the firms network principal

- Have whole of market access for mortgages and insurances

- Have appropriate level of PI cover in event of claim or complaint.

- Have GDPR compliant processes and policies, as well as fully trained staff adhering to this process.

- Ethics and behaviour is in line with OMA Vision and Values

- Work in line with OMA’s fair fee policy

- Have necessary systems and procedures in place to ensure full tracking and monitoring of commissions within their firm, including any re-writes or future business placed that originated from an OMA referral, as per introducer agreement.

Ongoing Assessment

- Pay OMA commissions due in the correct format, in a timely manner

- Report any concerns or issues to the correct channels, in a timely manner

- Principals respond according to KPI management agreements

- Only introduce new advisors with OMA pedigree / potential

OMA Advisor Assessment

We are picky! We ensure that the advisors we choose to work with not only have the right skills and specialist experience, but are nice people and hold the same values as we do.

- Fully CeMap qualified

- CAS advisor status (reviewed periodically every 6-12 months)

- Wide ranging lender spread (reviewed periodically every 6-12 months)

- Background checked and a proven history of compliant and accurate advice

- Have been specifically invited to work with OMA or were endorsed by other OMA accredited advisor or firm, a specialist lender or industry expert.

- Personify the OMA vision and values, ensuring that everyone gets the right advice, always treating customers fairly.

OMA Assessments

- Have passed all initial interview and on-boarding sessions

- Fully trained on all OMA systems (incl. Sourcing)

- Have passed OMA’s Core Online Assessment

- Have passed OMA’s Niche Online Assessment for niches they require

Ongoing Assessment

- Maintain competent Feedback scores

- Maintain competent KPIs

- Respond according to KPI management requirements, in a timely manner

- Engage with the OMA Community

OMA Advisor Academy

We don’t recruit firms and leave things to chance, we run a market leading training program for all advisors, with exams in specialist areas to ensure that they know their stuff before working with our customers.

OMA’s Advisor Charter

We ask every advisor to sign a service level agreement – we call our Advisor Charter. This ensures advisors handling our customers and users of our system understand and fully commit to treating customers in line with OMA values.

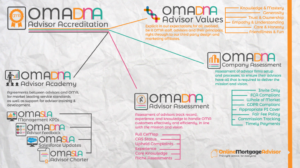

OMA Accreditation Overview

This map pulls together the 4 core elements of the Accreditation process.

OMA Accreditation Overview

About the author

Pete, an expert in all things mortgages, cut his teeth right in the middle of the credit crunch. With plenty of people needing help and few mortgage providers lending, Pete found great success in going the extra mile to find mortgages for people whom many others considered lost causes. The experience he gained, coupled with his love of helping people reach their goals, led him to establish Online Mortgage Advisor, with one clear vision – to help as many customers as possible get the right advice, regardless of need or background.

Pete’s presence in the industry as the ‘go-to’ for specialist finance continues to grow, and he is regularly cited in and writes for both local and national press, as well as trade publications, with a regular column in Mortgage Introducer and being the exclusive mortgage expert for LOVEMoney. Pete also writes for Online Mortgage Advisor of course!

Pete Mugleston

Mortgage Advisor, MD

We can help!

We know everyone's circumstances are different, that's why we work with expert mortgage brokers. Ask us a question and we'll get the best expert to help.

Get in touch today

Make an enquiry and we'll arrange for an experienced mortgage broker we work with to contact you straight away.