CIS Scheme Mortgages

If you are a construction industry contractor, you may wonder if you are eligible for a CIS mortgage - a mortgage broker can discuss everything you need to know when applying for a mortgage.

Do you currently work through a Construction Industry Scheme (CIS)?

Why use us?

Whatever your situation, at OnlineMortgageAdvisor we know that everyone's circumstances are different. That's why we only work with expert brokers who have a proven track record in securing mortgage approvals

-

Construction Industry Scheme Specialists

-

Higher chance of approval

-

Mortgage Approval Guarantee - or £100 back*

-

No impact on credit score

-

We don't charge a fee

-

There for you every step of the way

-

Rated excellent on Trustpilot, Feefo and Google

If you have any questions,

feel free to call us on 0808 189 2301

Author: Pete Mugleston

Mortgage Advisor, MD

Reviewer: Jon Nixon

Director of Distribution

How we reviewed this article:

Our experts continuously monitor changes in the financial space and work closely with qualified mortgage advisors for factual verification.

Here, we look at whether there are specific mortgages for construction industry contractors and subcontractors, and how those mortgages may work.

We identify how much you could borrow, how to make an application, and which lenders will consider your application.

Can a CIS worker get a mortgage?

Yes, it’s possible and you may be eligible via the Construction Industry Scheme (CIS) if you work as a contractor in this sector. The scheme was set up to help those working in the construction industry, who often have a high turnover but hefty expenses too. As a result, the subsequent lower net income could prevent you from accessing higher mortgage amounts, which you may have been able to afford.

There isn’t a specific home loan just for CIS workers as such – they’re exactly the same as a standard mortgage – but the term ‘CIS mortgage’ is often used when referring to an applicant who qualifies for this scheme.

How does CIS improve your mortgage chances?

For CIS scheme workers, mortgage lenders will assess how much they can borrow based on the gross pay shown on their payslips, rather than by using the average profit figures over the last 2-3 years trading accounts and/or SA302 tax statements (as would be typical when reviewing applications for someone who is self-employed).

The advantage here is that you may be able to borrow more for your mortgage using this gross amount rather than using a net profit figure. It’s also useful for someone who hasn’t been trading for very long as most lenders will look back over the last 12 months.

Speak to a CIS mortgage expert

Maximise your chance of approval with a specialist in CIS Mortgages

How to get a mortgage as a CIS contractor

Firstly, you need to register for the government scheme. You will often need to have been registered, and paid through the scheme, for at least 12 months before you can apply for a mortgage. If you are already registered, make an enquiry with us so we can match you with a specialist broker to guide you through the next steps.

The broker we match you with will be a contractor mortgage specialist who has a strong track record of helping CIS contractors secure finance. They will guide you through the following steps:

- Gathering the documents you’ll need: It’s important to have all the necessary documentary evidence ready – payslips, etc. – in advance so as not to slow down the application process.

- Downloading your credit reports: Click on the link for your free trial. Your broker can then help highlight any inaccuracies or outdated information that can be removed before you apply.

- Searching for the right mortgage deal for you: Your mortgage broker will be able to identify the mortgage lenders who will consider applications from CIS workers, saving you a lot of time and stress.

How much could you borrow?

Try our affordability calculator below to get a rough idea of your maximum borrowing.

CIS Mortgage Affordability Calculator

Our contractor mortgage calculator will tell you how much you can borrow, whether you work in an employed or self-employed capacity. Select your trading style below, enter the relevant details about your income and our calculator will do the rest.

You could borrow up to

Most lenders would consider letting you borrow

This is based on a multiple of 3-4.5 times your income, a standard calculation used by the majority of UK mortgage lenders. You should speak to a mortgage broker for bespoke calculations if you have been contracting for less than 12 months, your contract is coming to an end, or there is uncertainty around your long-term employment.

This is based on a multiple of 3-4.5 times your income, a standard calculation used by the majority of UK mortgage lenders. You should speak to a broker for bespoke calculations if you’ve been self-employed for less than 2-3 years, have declining profits or fluctuating income.

Some lenders would consider letting you borrow

This is based on 5 times your income, a calculation only some lenders are willing to offer. You may struggle to find a lender who will offer this income multiple to an employed contractor without the help of a broker, and you should seek advice from one regardless if there is any uncertainty around your employment situation.

This is based on 5 times your income, a calculation only some lenders offer. You might need a broker to access this salary multiple and should take advice from one regardless if you’ve been self-employed for less than 2-3 years, have declining profits or fluctuating income.

A minority of lenders would consider letting you borrow

Only a small number of options are available for employed contractors who want to borrow based on this salary multiple. Few UK mortgage lenders offer mortgages based on x6 income under any circumstances, and you’ll almost certainly need the help of a specialist mortgage broker who knows this corner of the market inside out to access them.

Only a small number of options are available for self-employed contractors who want to borrow based on this salary multiple, as few mortgage providers are willing to offer 6 times salary deals. You’ll almost certainly need the help of a mortgage broker to borrow this amount.

Get Started with an expert broker to find out exactly how much you could borrow.

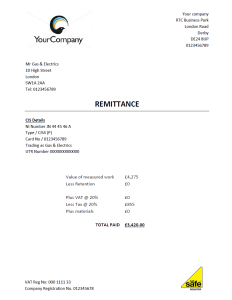

Example calculation

Take a look at the example payslip below, the figures the CIS mortgage lenders use will be based on the ‘value of measured work’ figure. In this example, it’s the £4,275 amount. Lenders will take the total sum of the last 12 months payslips to establish the total of your personal income.

Typical lending figures would be based on approximately 4-4.5 times this amount but could be less if you have other monthly commitments such as other mortgages, dependent children, loans, and credit cards.

Assuming this borrower earned £4,275 every month, the total income would be 4275 x 12 = £51,300. With no other outgoings, this person would be able to borrow approx. £205,200.

We're so confident in our service, we guarantee it.

We know it's important for you to have complete confidence in our service, and trust that you're getting the best chance of mortgage approval at the best available rate. We guarantee to get your mortgage approved where others can't - or we'll give you £100*

General eligibility criteria

The other criteria that applicants need to meet will not be largely different from other mortgage applications.

- CIS payslips – Mortgage providers will generally require at least 12 months’ worth of CIS payslips to consider an application. However, some may need fewer.

- Age – Lenders usually require applicants to be between 21 and 75 years old. Some may accept applications from older people if the rest of their application meets requirements.

- Deposit – Typically, the higher your deposit amount, and the better your loan-to-value ratio, the more you can borrow. Lenders often like to see a 10% deposit, though some may go to 5% in certain circumstances. You will usually find the better your LTV the better the rate you can secure.

- Credit history – Lenders look at a person’s credit history to determine the risk of lending to them. Usually, the fewer issues you have had, the more options you have available. If you’ve had bad credit in the recent past this doesn’t have to prevent you from still getting a mortgage. Speak to your broker and, together, you can review the specific issue you’ve had before deciding on the next steps.

Superb response and knowledgeable advisor

Steve, the financial advisor, contacted me within the hour and was very friendly, knowledgeable and professional. He seemed to relish my non standard requirement, diligently kept me updated during the day and we struck up a great relationship. Very impressed.

Peter Costello

Great Service

Everything has been smooth, contact has been nice and fast all of my questions have been answered fully

Martin

Very quick response

Very quick response from Pete. Very helpful, friendly and knowledgeable. I would definitely recommend. Thanks again Pete

Lindsey

Rated 4.8 out of 5 stars across Trustpilot, Feefo and Google

Which lenders will consider your application?

Currently, big high-street names like Barclays, Halifax and NatWest will consider such applications. However, there are plenty of lesser-known lenders that would be willing to extend a mortgage if applicants meet all criteria requirements. For example, Foundation Home Loans and Beverley Building Society are also know to consider CIS applicants.

There are many lenders that will accept a CIS mortgage application. However, mortgage providers who accept applicants registered with CIS are subject to change as are the terms and conditions under which they are willing to lend.

What if you have bad credit?

Having bad credit won’t automatically preclude you from getting a CIS mortgage, but it can limit the number of mortgage providers who will extend you a loan.

Your options will largely depend on what and when the bad credit issue was. If the bad credit was simply an instance of a missed mobile bill payment, and it was a long time ago, you may find that there are still plenty of lenders happy to accept your application.

However, if you have issues such as a previous IVA or CCJ, and the problem was relatively recent, the number of potential lenders may dwindle.

Get matched with a broker who specialises in CIS mortgages

Given that CIS mortgages can affect how much you can borrow, it can seem to make your application more complex, especially when faced with the wealth of choice on offer. Yet, finding the right product for you can mean that not only can you borrow more, but your mortgage application is accepted first time and you secure a rate you can afford under terms which work for you.

A specialist broker can therefore be incredibly helpful. Their in-depth knowledge can prove invaluable because they can advise you accurately on what is the best product for your situation. They’ll know which provider will accept your application while ensuring your interest rate is minimised and the amount borrowed is maximised.

Our free, no-obligation broker matching service will connect you with the best advisor for you. Call us on 0808 189 2301 or enquire with us today so we can put you in touch with a specialist.

Speak to a CIS mortgage expert

Maximise your chance of approval with a specialist in CIS Mortgages

FAQs

If you meet the criteria required by a provider for a mortgage under the Construction Industry Scheme, you’ll not find it any more difficult to have a mortgage application accepted.

In fact, if you have registered for the scheme, you may find it easier to get a mortgage than you would if you were simply self-employed. Self-employed individuals will often require 2-3 years’ worth of accounts before they can apply for a mortgage.

Ask us a question

We know everyone's circumstances are different, that's why we work with mortgage brokers who are experts in all different mortgage subjects.

Ask us a question and we'll get the best expert to help.

Get in touch today

Make an enquiry and we'll arrange for an experienced mortgage broker we work with to contact you straight away.

About the author

Pete, an expert in all things mortgages, cut his teeth right in the middle of the credit crunch. With plenty of people needing help and few mortgage providers lending, Pete found great success in going the extra mile to find mortgages for people whom many others considered lost causes. The experience he gained, coupled with his love of helping people reach their goals, led him to establish Online Mortgage Advisor, with one clear vision – to help as many customers as possible get the right advice, regardless of need or background.

Pete’s presence in the industry as the ‘go-to’ for specialist finance continues to grow, and he is regularly cited in and writes for both local and national press, as well as trade publications, with a regular column in Mortgage Introducer and being the exclusive mortgage expert for LOVEMoney. Pete also writes for Online Mortgage Advisor of course!

Pete Mugleston

Mortgage Advisor, MD