Mortgage Affordability of Public Sector Jobs in the UK

When looking for a mortgage, your application can be affected by several different factors. One, in particular, is your income, as how much you earn per annum will affect how much you can borrow from a mortgage lender and ultimately where you can afford to buy a home.

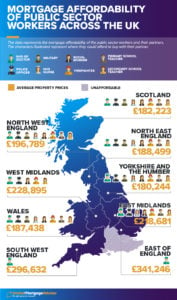

Intrigued to uncover which public sector jobs help us get on the property ladder, we sought to find out which public sector jobs could land us the most affordable mortgages in UK for single applicants, as well as public sector workers looking for a joint mortgage with another person with the average UK salary (£29,600).

Where can public sector workers afford to buy?

1. NHS GP

The public sector job earning the most, on average, per annum are NHS GPs, taking home an average salary of £64,999 in the UK.

Therefore, it is estimated that NHS GPs can afford mortgages up to £259,996, which means that they can afford to live in seven regions in the UK, out of 11 – West Midlands, East Midlands, North West England, North East England, Wales, Scotland, and Yorkshire and the Humber.

However, if an NHS GP chose to apply for a joint mortgage with someone else earning the average annual UK salary of £29,600, their combined annual salary would be £94,599, resulting in a mortgage of £378,296.

As a result, NHS GPs can afford to live in nine regions in the UK, including West Midlands, East Midlands, North West England, North East England, Wales, Scotland, Yorkshire and the Humber, the East of England, and South West England.

2. Firefighter

Firefighters have an average annual salary of £31,708, the second highest of the public sector roles. If a firefighter were buying a home alone, it is estimated that they could afford a mortgage up to £126,832 – less than the average UK house price of £239,196.

Despite being the second highest earners, our research can reveal that this leaves firefighters struggling to afford to live in any UK region if they were to purchase a home alone.

However, if firefighters were looking to buy a property with another person earning the average annual UK salary (£29,600), they could potentially afford a mortgage of around £245,232.

This means that with a joint mortgage, a firefighter could afford to live in seven different regions in the UK, including the West Midlands, East Midlands, North West England, North East England, Wales, Scotland, and Yorkshire.

3. Police Officer

Our research found that police officers may also struggle to afford a property if they were going it alone, since their annual average salary in the UK is just £29,994. This means that they could only afford a mortgage up to £119,976 – less than the average price of a property in the UK.

However, if police officers wanted to buy a property with another person earning the average annual UK salary (£29,600), they could potentially afford a mortgage up to £238,376.

As a result, they could afford to live in seven regions in the UK, including the West Midlands, East Midlands, North West England, North East England, Wales, Scotland, and Yorkshire.

4. Social Worker

With an average annual salary of £29,837, social workers were also found to struggle to afford to buy alone in the UK, with people in this public sector role only affording a mortgage of up to £119,348 – also less than the average UK property price.

However, if they chose to buy with another person earning the average annual salary of £29,600, social workers could potentially afford a mortgage of up to £237,748.

This means that, like firefighters and police officers, social workers could afford a property in seven regions in the UK, including the West Midlands, East Midlands, North West England, North East England, Wales, Scotland, and Yorkshire.

5. Secondary School Teacher

Secondary school teachers have an average annual salary of £29,644, which means they could potentially be offered a mortgage of £118,576. Unfortunately, this means that those working in this public sector job may struggle to afford a property alone in any region of the UK.

However, by pairing their annual salary with someone else who earns the average annual salary in the UK, secondary school teachers could potentially afford a mortgage of up to £236,976.

This means that they could afford a property in seven regions in the UK, including the West Midlands, East Midlands, North West England, North East England, Wales, Scotland, and Yorkshire.

6. Primary School Teacher

Comparatively, primary school teachers were paid even less than secondary school teachers, with an average annual salary of £26,481 – less than the average UK salary of £29,600.

As a result, primary school teachers may struggle to purchase a property alone since they can only afford a mortgage up to £105,924 by themselves, therefore making it difficult to find a property to purchase across all regions of the UK.

If primary school teachers applied for a joint mortgage with someone else earning the UK average annual salary, they could potentially afford a mortgage of around £224,324.

This means that they could potentially afford to buy a property in six regions in the UK, including the East Midlands, North West England, North East England, Wales, Scotland, and Yorkshire and the Humber.

7. NHS Nurse

NHS nurses have an average annual salary of £25,106 in the UK, meaning that they could potentially afford a mortgage of around £100,424 if they sought to purchase a property solo. As a result, NHS nurses may struggle to afford to live in any UK region.

However, if NHS nurses were to seek a mortgage with someone else earning the average annual salary in the UK, they may be able to afford a mortgage for £218,824.

With this figure, they would be able to live in six regions in the UK, including the East Midlands, North West England, North East England, Wales, Scotland, and Yorkshire and the Humber.

8. Military

Our research found that military roles are the lowest paid within the public sector, having an average annual salary of £20,539 in the UK.

This means that they could only afford a mortgage of £82,156 if they were to purchase a property alone, thus meaning that they may struggle to buy their own home in any part of the UK as a single buyer.

By pairing their military salary with someone else earning the UK annual average wage, they may be able to afford a mortgage up to £200,556.

Whilst this does enhance their ability to get a mortgage, they could only afford to buy a property across five regions in the UK, when taking into account the average house price for each region: North West England, North East England, Wales, Scotland, and Yorkshire and the Humber.

Mortgage affordability for public sector workers in London

Intrigued to uncover whether working in London increases the chance of public sector workers getting on the property ladder, we sought to investigate which public sector jobs could land us the most affordable mortgages in London for single applicants, as well as public sector workers looking for a joint mortgage with a friend, partner or family member who earns the average yearly London wage (£34,473).

Bearing in mind that the average house price in London is £659,749, our research found that public sector workers in the city may struggle to buy a property – even when buying with someone else earning the average London salary.

In fact, even those working in the highest paid public sector roles – such as NHS GPs with an annual salary of £84,000 – may not be able to afford a property in London and may decide to live on the outskirts in commuter towns instead.

The average property price per region in the UK

Methodology:

- In order to find the mortgage affordability per public sector job, the average annual salaries across the UK were found using PayScale, Indeed, and Glassdoor. (London weighting salary was also taken into consideration; the averages were found using Glassdoor and PayScale).

- Following this, the house average price per city was then found by using Zoopla’s House Pricing tool.

- A lot of lenders will lend up to four times salary, with quite a few lending more than than. We took the median number for each public sector job and applied the 4x multiple in order to calculate their mortgage affordability. Conditions of affordability were excluded.