Getting a Mortgage on a Thatched Roof House

See how you could secure a mortgage on a thatched roof property with expert help and advice

Is the property of Non-Standard Construction?

Author: Pete Mugleston

CeMAP Mortgage Advisor, MD

Thatched properties are known for their character and charm, but securing a mortgage for one can be more challenging. Due to specialist maintenance requirements and perceived fire risks, many lenders classify them as ‘non-standard properties,’ which can limit mortgage options compared to conventional homes.

However, the good news is that securing a mortgage for a thatched home is far from impossible. The advisors we work with specialise in finding lenders who understand these properties, whether you’ve been declined elsewhere or have a bad credit history.

As with any non-standard construction, buying a thatched property comes with higher risk factors in the eyes of lenders. This can mean stricter lending criteria, potential insurance hurdles, and resale considerations. Before committing, it’s crucial to understand how owning a thatched home might affect your mortgage options.

Here’s everything you need to know about getting a mortgage for a thatched property and how to improve your chances of approval.

What is a thatched roof?

A thatched roof is a traditional roofing method made from dried plant materials such as straw, reeds, heather, or rushes, which are tightly bundled and layered to create a durable, weather-resistant covering.

Types of thatched roof

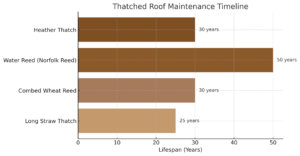

Thatched roofs are made from various natural materials, each with its own characteristics, lifespan, and maintenance needs. The type of thatch used often depends on the region, climate, and historical traditions of the property. Below are the most common types of thatched roofs:

- Long straw thatch: Made from loosely bound wheat straw, this thatch has a shaggy, layered appearance and typically lasts 25-30 years, requiring regular maintenance. It is one of the most traditional styles commonly found in southern and eastern England.

- Combed Wheat Reed Thatch: A neater and more uniform version of long straw thatch, this type is carefully combed to remove waste, resulting in a tidier, more compact look. It lasts 25-40 years and is mainly used in the South West of England.

- Water Reed Thatch (Norfolk Reed): This is the most durable thatch type, lasting 40-60 years. It is made from tightly packed water reeds harvested from wetlands. It has a smooth, uniform finish and is highly weather-resistant, making it popular in Norfolk and East Anglia.

- Heather Thatch: Traditionally used in Scotland and parts of Ireland, this thatch consists of bundled heather stems, giving it a coarse, rustic look. While naturally weather-resistant and insulating, it is heavier than other thatch types and lasts 20-30 years.

Thatched roof maintenance timeline

Can I get a mortgage on a thatched cottage property?

There’s nothing quite like a thatched cottage’s timeless beauty and charm, but is it possible to get a mortgage on one? The short answer is yes, absolutely – but they can be slightly more challenging to obtain.

This is due to the risk thatched cottages pose as ‘non-standard’ constructions, meaning potentially fewer mortgage lenders and insurance providers to choose from.

So, what are the reasons for this? Read on to find out…

Speak To An Expert In Non-Standard Properties

Receive a Callback From a Qualified Mortgage Advisor

-

Help With Your Unique Situation

-

Receive Personalised Advice

-

A Mortgage Advisor Will Guide You Through The Process

What are the risks with buying a thatched roof property?

Contrary to popular belief, thatched properties do not necessarily have a higher risk of catching fire than other roof types. However, they require regular maintenance, such as re-ridging, which can be costly and may concern lenders.

Re-ridging is typically required every 10–15 years for most thatched roofs, though this varies based on the materials used. Water reed, for example, may require less frequent maintenance. This means affordability could be a concern, and lenders may be more stringent with income checks and affordability requirements for thatched property loans than other mortgage types.

So, if you’re looking to invest in a thatched home, be sure to consider the following before putting an offer down:

Insurance Costs and Availability

Thatched homes are more expensive to insure due to higher fire risks and specialist repairs.

- Look for specialist home insurance providers who cover thatched properties

- Ensure the property has fire safety measures (e.g., chimney lining, smoke alarms)

- Expect higher premiums and check if the thatch has a fire-retardant treatment

Roof Condition & Maintenance Requirements

A thatched roof requires more upkeep than standard tiled or slate roofs.

- Check the last rethatching date – Water reed lasts 40-60 years, while straw thatch needs replacing every 25-30 years

- Regular maintenance is essential – Ridging needs replacing every 10-15 years

- Ensure the roof is well-ventilated to prevent moisture buildup and rot

Fire Safety Precautions

Fire is one of the biggest concerns with thatched homes.

- Chimneys should be lined and regularly swept to prevent sparks.

- Install heat detectors, fire-resistant barriers, and external fire retardants.

- Electrical wiring should be up to date – old wiring increases fire risks

Listed Building Restrictions

Many thatched homes are listed buildings, meaning there are strict planning regulations.

- You may need planning permission to change the roof material or structure.

- Repairs and replacements must often match the original materials.

- Check local authority rules before making modifications

Local Thatched Roof Specialists

Finding experienced thatchers for repairs is crucial but can be expensive.

- Thatched roofing is a specialist trade, so repairs and maintenance may take longer than standard roofing work.

- Costs vary based on roof type, material, and region

What other factors impact eligibility for a mortgage on a thatched property?

Lenders will also consider your circumstances before approving your mortgage, including considerations regarding a thatched-roof property. Here are some of the factors they will consider.

Income & affordability

As mentioned, affordability tends to be one of the biggest concerns for mortgage providers when lending for a thatched home. For this reason, many lenders restrict the loan-to-value (LTV) on a thatched property to 75%. Your income is a good indication as to whether that will allow you to keep up with your repayments for the requested loan amount.

Typically, providers impose a cap of 4.5x your annual salary when calculating how much they’re willing to loan you. While some lenders can be more generous, potentially offering 5 times or 6 times your salary, you may find that you are more restricted with thatched properties. It all depends on the risk your home poses and other factors.

Get in touch to speak to a non-standard property expert and find out more about how your income may impact your application.

Deposit

Having a larger mortgage deposit together can positively impact your application as it may open you up to a broader variety of lender options and access to more competitive rates.

While standard residential mortgages can offer LTVs of up to 95%, thatched properties often require a larger deposit due to their higher perceived risk. Many lenders restrict LTV to 75% or lower for these homes.

Employment type

Employment status and job role can also considerably impact your mortgage application and how favourably lenders look at you. This is because some roles are deemed higher risk than others.

For example, if you’re self-employed or looking for a mortgage with a temporary work contract, lenders may be more cautious than if you’ve been in a stable, full-time role for several years. This is especially significant if you’re looking for a mortgage on a non-standard build, such as a thatched roof property or a concrete house.

Self-employed applicants can still secure a thatched property mortgage, but lenders may require proof of consistent income, typically two to three years of accounts.

Age

Lenders often consider older applicants to be at higher risk and often have age restrictions, shorter borrowing periods, and/or loan caps in place. This is another factor that could considerably impact your eligibility for an already high-risk mortgage.

However, there are some providers out there who are happy to lend to older borrowers. Depending on the risk posed by the thatched property alongside other circumstances, they may be more than happy to lend to you, provided you meet the affordability requirements.

Bad credit history

As discussed, every mortgage provider has different requirements and eligibility criteria, and the same applies to bad credit. Generally, it depends on the recency and severity of the issue.

While some lenders consider applicants with adverse credit, mortgage rates are often higher. Consulting a specialist broker can help identify lenders offering the most competitive deals available for your situation.

If you’ve experienced any of the above and want to know how it will impact your mortgage application, contact us to be referred to one of the bad credit experts we work with.

We're so confident in our service, we guarantee it.

We know it's important for you to have complete confidence in our service, and trust that you're getting the best chance of mortgage approval at the best available rate. We guarantee to get your mortgage approved where others can't - or we'll give you £100*

Talk to a non-standard property expert today

It is recommended that you seek professional advice from a mortgage broker before getting a mortgage on a thatched roof property.

Finding a mortgage for a thatched property requires expert knowledge of non-standard construction financing. Our broker-matching service connects you with a specialist who can help you secure the best possible deal. Call 0330 818 7026 or enquire online for a no-obligation consultation today.

Speak to an expert in mortgages

Maximise your chances of approval with a specialist broker

Pete Mugleston

CeMAP Mortgage Advisor, MD

Pete, a CeMAP-qualified mortgage advisor and an expert in all things mortgages, cut his teeth right in the middle of the credit crunch. With plenty of people needing help and few mortgage providers lending, Pete successfully went the extra mile to find mortgages for people whom many others considered lost causes. The experience he gained and his love of helping people reach their goals led him to establish Online Mortgage Advisor, with one clear vision – to help as many customers as possible get the right advice, regardless of need or background.

Pete’s presence in the industry as the ‘go-to’ for specialist finance continues to grow, and he is regularly cited in and writes for both local and national press, as well as trade publications, with a regular column in Mortgage Introducer and being the exclusive mortgage expert for LOVEMoney. Pete also writes for Online Mortgage Advisor of course!

Superb response and knowledgeable advisor

Steve, the financial advisor, contacted me within the hour and was very friendly, knowledgeable and professional. He seemed to relish my non standard requirement, diligently kept me updated during the day and we struck up a great relationship. Very impressed.

Peter Costello

Knowledgeable and Supportive

The team were fantastic and really knowledgeable and supportive. They answered all questions promptly and came back to me with regular updates. I have already recommended them and will use them again.

Dorothy

Prompt and Professional

A very prompt and professional service. The advise and guidance has been so valuable as a first time buyer.

Ayesha