Why We’ve Built a Customer Wellbeing Portal On Our Website

Why we've built a customer wellbeing portal on our website

Author: Pete Mugleston

CeMAP Mortgage Advisor, MD

Why the hell are we doing this?

The wellbeing portal has come about due to some shocking results arising from a large-scale customer survey that we conducted. You can view the survey in full by clicking here.

As a team, we are constantly looking at our business and assessing where we can add more value – whether that’s offering our customers more information on a subject, a better experience with slicker web forms, more intuitive systems and improving our broker network, or even offering our staff different incentives and benefits.

Dave and Pete often sit down and bat a few thoughts around, and the idea arose to look into how many of our customers find the whole house move, mortgage thing a real emotional challenge, and try to see what we could change to improve our process.

What started out as a short survey evolved into a project that uncovered some real insights into what people think and experience throughout the home buying process, and that actually, there’s not a lot of support available from the industry to help.

What are we doing about it?

Owed more to the unlikely circumstances with which Dave and Pete met (on a web forum of all places) and rather too many shortcomings, they became friends over a mutual thirst for personal and professional development.

Fast-forward to today, and they’ve spent 15 years studying all sorts of self-help tools, techniques, courses and enjoyed no end of hilarious scenarios that will have to wait for another day to share. This of course, was not without a good dollop of stress and anxiety throughout, and both have been on their own journey.

Why is this relevant? Well, as a result of their experience, Dave and Pete wanted to share some of what they found were the most useful resources available, and to develop somewhat of a support network for our customers, employees, and whoever else wants to use it.

So what are we actually doing?

The first step for us is this wellbeing section of our site. We’ll continue to collate additional material, and be promoting and encouraging our customers to engage with it and us. We are also in the process of adding to our Cope With: Video series, and scheduling some exciting seminars with friend of the business Jamie smart, author of bestseller Clarity, and have a few other irons in the fire!

We are also incredibly interested to know what you think, and are welcoming in feedback and suggestions from our customers, readers, anyone really.

What were the results?

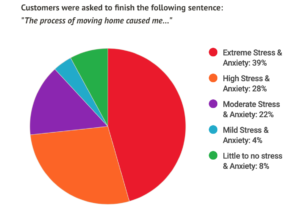

The results were more than alarming, with 92% of people experiencing mild or stronger levels of stress or anxiety and almost 40% of people declaring extreme levels at some point throughout the process.

Some of the biggest stressors and pain points recorded were the threat of a vendor pulling out, a chain breaking at the last minute, solicitors taking ages, and even disagreements with a partner over various things.

Most people moving house are left to find a property, list with the right agent, get the right mortgage, solicitor, insurance, removals etc. and at each and every step are under the threat of the whole thing falling down, often completely out of their control.

There are a few professionals that help along the way (and the good ones will take more ownership over areas outside their expertise), but nevertheless, some stress seems an inevitable part of the experience.

Pete Mugleston

CeMAP Mortgage Advisor, MD

Pete, a CeMAP-qualified mortgage advisor and an expert in all things mortgages, cut his teeth right in the middle of the credit crunch. With plenty of people needing help and few mortgage providers lending, Pete successfully went the extra mile to find mortgages for people whom many others considered lost causes. The experience he gained and his love of helping people reach their goals led him to establish Online Mortgage Advisor, with one clear vision – to help as many customers as possible get the right advice, regardless of need or background.

Pete’s presence in the industry as the ‘go-to’ for specialist finance continues to grow, and he is regularly cited in and writes for both local and national press, as well as trade publications, with a regular column in Mortgage Introducer and being the exclusive mortgage expert for LOVEMoney. Pete also writes for Online Mortgage Advisor of course!